Equity Shares or commonly called as shares, represent a share of ownership in a company. An investor who invests in shares of a company is called a shareholder, and is entitled to receive all corporate benefits, like dividends, out of the profits of the company. The investor is also entitled to receive the right to cast a vote with regard to the decision making process of the company at General meeting of the company.

Debt Securities represent money that is borrowed by the company / institution from an investor and must be repaid to the investor. Debt securities are also called as debentures or bonds. An investor who invests in debt securities is entitled to receive payment of interest/coupons and repayment of principal (i.e. the money invested). Debt Securities are issued for a fixed term, at the end of which the securities can be redeemed by the issuer of securities. Debt securities can be secured (backed by collateral) or unsecured.

Derivatives are financial instruments whose value depends upon the value of another asset such as shares, debt securities, commodities, etc. The main types of exchange traded derivatives are futures and options.

Mutual Funds are type of financial instruments made up of a pool of money collected from many investors. These funds/ mutual funds, then, invest in securities such as shares, bonds, money market instruments and other assets.

Securities Market is a place where companies can raise funds by issuing securities such as equity shares, debt securities, etc. to the investors (public) and also is a place where investors can buy or sell various securities (shares, bonds, etc.). Once the shares (or securities) are issued to the public, the company is required to list the shares (or securities) on the recognized stock exchanges. Securities Market is thus a part of the Capital Market.

The primary function of the securities market is to enable allocation of savings from investors to those who need it. This is done when investors make investments in securities of companies / entities which are in need of funds. The investors are entitled to get benefits like interest, dividend, capital appreciation, bonus shares, etc. Such investments contribute to the economic development of the country.

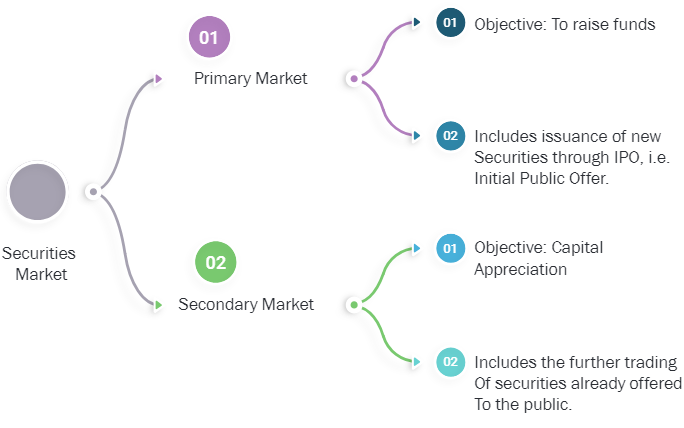

Securities market has two interdependent and inseparable segments, which are mentioned as below: